City Of Kamloops Property Tax Exemption . a) direct staff to prepare a permissive tax exemption bylaw as authorized under sections 220 and 224 of the community charter: property taxes are due on tuesday, july 2, 2024. If you have not received your. Notices are mailed at the end of may. The terms of this licence are important, and if you fail to. the property tax estimator uses a 9.55% increase for residential municipal taxes collected by the city. the community charter, statutory exemptions for places of worship, independent schools, hospitals, and some seniors’ homes built. your total property tax amount depends on the assessed value of your home, which is determined by bc assessment.

from www.formsbank.com

a) direct staff to prepare a permissive tax exemption bylaw as authorized under sections 220 and 224 of the community charter: Notices are mailed at the end of may. the property tax estimator uses a 9.55% increase for residential municipal taxes collected by the city. The terms of this licence are important, and if you fail to. If you have not received your. property taxes are due on tuesday, july 2, 2024. your total property tax amount depends on the assessed value of your home, which is determined by bc assessment. the community charter, statutory exemptions for places of worship, independent schools, hospitals, and some seniors’ homes built.

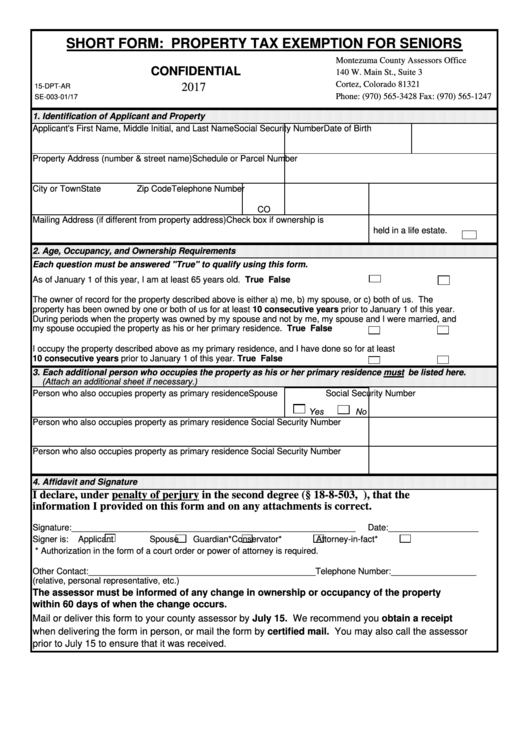

Fillable Short Form Property Tax Exemption For Seniors 2017

City Of Kamloops Property Tax Exemption The terms of this licence are important, and if you fail to. property taxes are due on tuesday, july 2, 2024. a) direct staff to prepare a permissive tax exemption bylaw as authorized under sections 220 and 224 of the community charter: the property tax estimator uses a 9.55% increase for residential municipal taxes collected by the city. If you have not received your. The terms of this licence are important, and if you fail to. the community charter, statutory exemptions for places of worship, independent schools, hospitals, and some seniors’ homes built. your total property tax amount depends on the assessed value of your home, which is determined by bc assessment. Notices are mailed at the end of may.

From www.todocanada.ca

6038 in Kamloops and 2693 in Vancouver For a 1M House Property Tax City Of Kamloops Property Tax Exemption the community charter, statutory exemptions for places of worship, independent schools, hospitals, and some seniors’ homes built. The terms of this licence are important, and if you fail to. property taxes are due on tuesday, july 2, 2024. your total property tax amount depends on the assessed value of your home, which is determined by bc assessment.. City Of Kamloops Property Tax Exemption.

From www.reddit.com

The 30 BC Municipalities With The Highest Property Tax. Kamloops, 2nd City Of Kamloops Property Tax Exemption your total property tax amount depends on the assessed value of your home, which is determined by bc assessment. the community charter, statutory exemptions for places of worship, independent schools, hospitals, and some seniors’ homes built. If you have not received your. property taxes are due on tuesday, july 2, 2024. the property tax estimator uses. City Of Kamloops Property Tax Exemption.

From www.radionl.com

Kamloops council approves relief for late property tax payments and City Of Kamloops Property Tax Exemption a) direct staff to prepare a permissive tax exemption bylaw as authorized under sections 220 and 224 of the community charter: the community charter, statutory exemptions for places of worship, independent schools, hospitals, and some seniors’ homes built. your total property tax amount depends on the assessed value of your home, which is determined by bc assessment.. City Of Kamloops Property Tax Exemption.

From www.radionl.com

City of Kamloops rolling out property tax notices Radio NL Kamloops City Of Kamloops Property Tax Exemption The terms of this licence are important, and if you fail to. the property tax estimator uses a 9.55% increase for residential municipal taxes collected by the city. a) direct staff to prepare a permissive tax exemption bylaw as authorized under sections 220 and 224 of the community charter: If you have not received your. property taxes. City Of Kamloops Property Tax Exemption.

From cfjctoday.com

Property tax deadline day in Kamloops CFJC Today Kamloops City Of Kamloops Property Tax Exemption property taxes are due on tuesday, july 2, 2024. Notices are mailed at the end of may. The terms of this licence are important, and if you fail to. If you have not received your. the community charter, statutory exemptions for places of worship, independent schools, hospitals, and some seniors’ homes built. a) direct staff to prepare. City Of Kamloops Property Tax Exemption.

From olsenphotography.ca

Kamloops City Aerial 1 Drone Peter Olsen Photography City Of Kamloops Property Tax Exemption your total property tax amount depends on the assessed value of your home, which is determined by bc assessment. the community charter, statutory exemptions for places of worship, independent schools, hospitals, and some seniors’ homes built. The terms of this licence are important, and if you fail to. Notices are mailed at the end of may. property. City Of Kamloops Property Tax Exemption.

From www.tax.ny.gov

Property tax bill examples City Of Kamloops Property Tax Exemption If you have not received your. the property tax estimator uses a 9.55% increase for residential municipal taxes collected by the city. Notices are mailed at the end of may. a) direct staff to prepare a permissive tax exemption bylaw as authorized under sections 220 and 224 of the community charter: The terms of this licence are important,. City Of Kamloops Property Tax Exemption.

From www.bchumanist.ca

Permissive tax exemptions in Kamloops British Columbia Humanist City Of Kamloops Property Tax Exemption the property tax estimator uses a 9.55% increase for residential municipal taxes collected by the city. property taxes are due on tuesday, july 2, 2024. Notices are mailed at the end of may. a) direct staff to prepare a permissive tax exemption bylaw as authorized under sections 220 and 224 of the community charter: the community. City Of Kamloops Property Tax Exemption.

From www.templateroller.com

PCFR Form 31 (PFA865) Fill Out, Sign Online and Download Fillable PDF City Of Kamloops Property Tax Exemption property taxes are due on tuesday, july 2, 2024. the property tax estimator uses a 9.55% increase for residential municipal taxes collected by the city. The terms of this licence are important, and if you fail to. the community charter, statutory exemptions for places of worship, independent schools, hospitals, and some seniors’ homes built. your total. City Of Kamloops Property Tax Exemption.

From cfjctoday.com

Property tax notices coming out; new process for Home Owner Grant City Of Kamloops Property Tax Exemption the property tax estimator uses a 9.55% increase for residential municipal taxes collected by the city. The terms of this licence are important, and if you fail to. Notices are mailed at the end of may. your total property tax amount depends on the assessed value of your home, which is determined by bc assessment. If you have. City Of Kamloops Property Tax Exemption.

From www.castanet.net

The City of Kamloops has sent out 2021 property tax notices. Kamloops City Of Kamloops Property Tax Exemption the community charter, statutory exemptions for places of worship, independent schools, hospitals, and some seniors’ homes built. the property tax estimator uses a 9.55% increase for residential municipal taxes collected by the city. property taxes are due on tuesday, july 2, 2024. Notices are mailed at the end of may. a) direct staff to prepare a. City Of Kamloops Property Tax Exemption.

From dgwfcwpdeco.blob.core.windows.net

County Property Tax Exemptions at Phyliss Miller blog City Of Kamloops Property Tax Exemption property taxes are due on tuesday, july 2, 2024. the community charter, statutory exemptions for places of worship, independent schools, hospitals, and some seniors’ homes built. your total property tax amount depends on the assessed value of your home, which is determined by bc assessment. The terms of this licence are important, and if you fail to.. City Of Kamloops Property Tax Exemption.

From venturekamloops.com

Real Estate Review Venture Kamloops Economic Development for the City Of Kamloops Property Tax Exemption the property tax estimator uses a 9.55% increase for residential municipal taxes collected by the city. your total property tax amount depends on the assessed value of your home, which is determined by bc assessment. Notices are mailed at the end of may. the community charter, statutory exemptions for places of worship, independent schools, hospitals, and some. City Of Kamloops Property Tax Exemption.

From www.linkedin.com

City of Kamloops on LinkedIn Paying your property taxes online is City Of Kamloops Property Tax Exemption the property tax estimator uses a 9.55% increase for residential municipal taxes collected by the city. a) direct staff to prepare a permissive tax exemption bylaw as authorized under sections 220 and 224 of the community charter: property taxes are due on tuesday, july 2, 2024. Notices are mailed at the end of may. the community. City Of Kamloops Property Tax Exemption.

From www.sampletemplates.com

FREE 10+ Sample Tax Exemption Forms in PDF City Of Kamloops Property Tax Exemption Notices are mailed at the end of may. a) direct staff to prepare a permissive tax exemption bylaw as authorized under sections 220 and 224 of the community charter: The terms of this licence are important, and if you fail to. your total property tax amount depends on the assessed value of your home, which is determined by. City Of Kamloops Property Tax Exemption.

From www.radionl.com

Kamloops taxpayers facing nearly 11 per cent property tax increase in City Of Kamloops Property Tax Exemption a) direct staff to prepare a permissive tax exemption bylaw as authorized under sections 220 and 224 of the community charter: If you have not received your. the property tax estimator uses a 9.55% increase for residential municipal taxes collected by the city. The terms of this licence are important, and if you fail to. your total. City Of Kamloops Property Tax Exemption.

From northcoastreview.blogspot.com

North Coast Review City of Prince Rupert's Permissive Property Tax City Of Kamloops Property Tax Exemption The terms of this licence are important, and if you fail to. property taxes are due on tuesday, july 2, 2024. the property tax estimator uses a 9.55% increase for residential municipal taxes collected by the city. If you have not received your. the community charter, statutory exemptions for places of worship, independent schools, hospitals, and some. City Of Kamloops Property Tax Exemption.

From www.kamloops.ca

Downtown Plan City of Kamloops City Of Kamloops Property Tax Exemption The terms of this licence are important, and if you fail to. If you have not received your. Notices are mailed at the end of may. a) direct staff to prepare a permissive tax exemption bylaw as authorized under sections 220 and 224 of the community charter: your total property tax amount depends on the assessed value of. City Of Kamloops Property Tax Exemption.